Financial bubble reaches U.S. universities

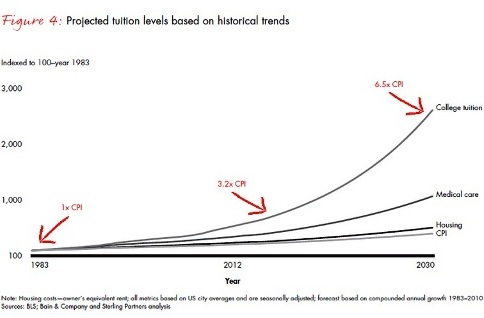

American universities are facing a dire financial future,according to a

Last year, an investigation by Moody’s Analytics illustratedthis warning that student loans may be the next financial

source: Bain & Company,Sterling Partners

Respond to disruptive innovation like onlineeducation

A second factor contributing to worsening balance sheets ofAmerican universities is scarcer financial support on behalf offederal and state governments.

Consequently, two key figures have taken a hit. First of all,the equity ratio (equity over assets) has decreased for manyuniversities putting them in danger of bankruptcy. Secondly, theexpense ratio (expenses over revenues) has climbed making theiroperations increasingly unprofitable. In short, “institutions havemore liabilities, higher debt service and increasing expensewithout the revenue or the cash reserves to back them up,” it saysin the

Publishing their findings

Meest Gelezen

Vrouwen houden universiteit draaiende, maar krijgen daarvoor geen waardering

Wederom intimidatie van journalisten door universiteit, nu in Delft

‘Burgerschapsonderwijs moet ook verplicht worden in hbo en wo’

Raad van State: laat taaltoets nog niet gelden voor hbo-opleidingen

Hbo-docent wil wel rolmodel zijn, maar niet eigen moreel kompas opdringen